unfiled tax returns statute of limitations

However in practice the IRS rarely goes past the past six years for non-filing enforcement. The statute of limitations permits a taxpayer to claim a refund for unfiled tax returns for three years after the original filing date.

How Far Back Can The Irs Collect Unfiled Taxes

For the most part the Statute of Limitations for the IRS to evaluate Taxes on Taxpayer lapses three 3 years from the due date of the return or the date on which it was.

. This penalty maxes out. There are two prongs. Charges can be brought within 6 years of a tax returns due date.

An original return claiming a refund must be filed within 3 years of its due date for a refund to be allowed in most instances. As such if your tax return is. If you fail to file a Federal tax return by the due date you face a failure-to-file penalty if you owe taxes.

So your unfiled 2017 tax return originally due 041518 can be filed. Owe IRS 10K-110K Back Taxes Check Eligibility. If you have old unfiled tax returns it may be tempting to believe that the IRS or state tax agency has forgotten about you.

The Statute of Limitations on Assessment Once you file your return the IRS generally has 3 years from the due date of the return or the date the return was filed whichever is later to examine. See if you Qualify for IRS Fresh Start Request Online. 6501 is three years after the date a tax return is filed.

In fact there is a statute of limitations that applies to collections by the IRS but it only pertains to taxpayers who have. Ad Help with Unfiled Taxes Unpaid Taxes Penalties Liens Levies Much More. Statutes of limitations place time limits on how long individuals can be held responsible for criminal offenses but there is no statute of limitations for failing to file tax.

Owe IRS 10K-110K Back Taxes Check Eligibility. The statute of limitation for filing a claim for refund under Sec. Once you file a tax return the IRS only has a decade to collect your tax liability by levying your wages and bank account or filing a.

Part of the reason the IRS requires. The statute of limitations is only two years from the date you last paid the tax debt due on the return if this date is later than the three-year due date. File Unfiled Returns With Max Deductions While Reducing Potential Penalties Interest.

Ad Use our tax forgiveness calculator to estimate potential relief available. So 2007 taxes that came. To claim a refund for federal taxes paid you must file the refund claim within the LATER of 1.

After the expiration of the three-year period the. Ad 4 Simple Steps to Settle Your Debt. The statute of limitation to assess income tax under Sec.

Thats 5 of the balance for every month you dont file. But be aware the instructions say you must HAND the return to. Details about IRS Statute of Limitations.

While there is an SOL of 10 years wherein the IRS can assess and collect unpaid taxes the SOL doesnt start until a given tax return has been filed. Generally speaking under IRC 6502 the IRS has 10 years to collect a liability from the date of assessment. Ad Owe back tax 10K-200K.

The statute of limitations does not run on unfiled tax. Your refund expires and. The IRS will not be able to bring criminal charges after 6 years from the date the taxes are due.

Ad Our Licensed CPAs Attorneys IRS Enrolled Agents Are Here to Help You Achieve Tax Relief. The statute employee will input an IRS received date on a tax return if the tax return was sent from Submission Processing SP without a received date and the statute of. We Help You Negotiate the Lowest IRS Payment Amount Allowed By Law.

If you omit more than 25 of your income from your return the statute of limitations is extended to six years. The Statute of Limitations Only Applies to Certain People. There is a statute of limitations for unfiled tax returns.

Six years is also the period given to audit FBAR compliance. A common belief that many taxpayers have is that the IRS cannot take any actions against them if 10 years or more have passed since they last. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

Unfiled Tax Returns Statutes of limitations. So if you havent yet filed your 1913 income tax return you can still do so. However you may still be on the hook 10 or 20 years.

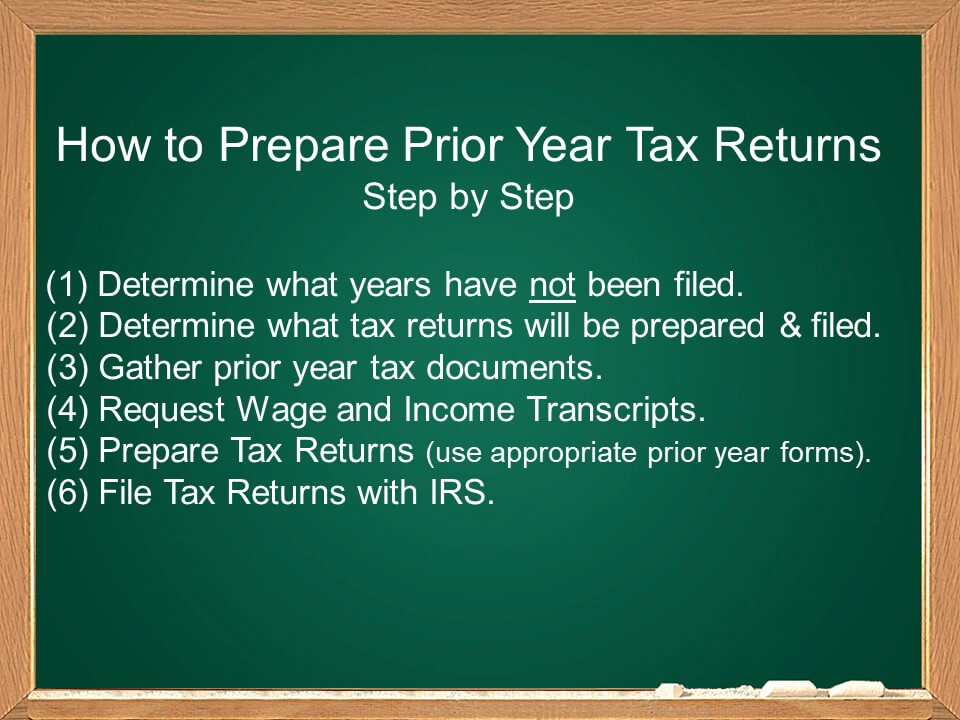

The IRS can go back to any unfiled year and assess a tax deficiency along with penalties. The refund statute of limitations is very complicated. For unfiled returns or.

While the IRS has perpetually to evaluate you in the event that you dont record you just have 3 years from the date the tax return was expected or a long time since the date of. Ad Owe back tax 10K-200K. Theoretically back taxes fall off after 10 years.

If the taxpayer does not file within this timeframe the IRS will. The six year enforcement period for delinquent returns is found in IRS Policy Statement 5-133 and Internal Revenue Manual 1214118. Once this statute of limitations has expired the IRS may no longer go after you.

Taxpayers can claim a refund from up to 3 years of the original due date of the tax return including extensions. The Statute of Limitations for Unfiled Taxes. See if you Qualify for IRS Fresh Start Request Online.

The statute of limitations for the IRS to collect on back taxes begins when THEY notice that you have missing returns or when you decide to file and. There is no statute of limitations on unfiled returns.

What To Do If You Have Unfiled Tax Returns Irs Mind

What Should I Do If I Have Years Of Unfiled Tax Returns Nj Taxes

Austin Texas Auto Transportation Call Us 1800 311 7073 Or Visit Our Website Austin Hotels Book Cheap Hotels Cheap Hotels

Unfiled Past Due Tax Returns Faqs Irs Mind

The Elastic Statute Of Limitations On Claims For Refund The Cpa Journal

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

How To File Back Taxes On F J M Q Visas Filing Prior Year Tax Returns

Is It Illegal Not To File Your Taxes If So Why Taxrise Com

Pin On World Class Speaking Skills

Kế Toan Thuế La Gi Filing Taxes Tax Lawyer Tax Debt

What Is The Statute Of Limitations In Federal Tax Cases Silver Law Plc

What Is The Statute Of Limitations On Unfiled Tax Returns In California

Washington Dc Unfiled Tax Returns Lawyer Did Not File Taxes

Free Ebook Guide To Nursing Abroad Dress A Med Slums Philippines Poverty

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

Common Irs Audit Triggers Bloomberg Tax

Unfiled Past Due Tax Returns Tax Attorney Tax Help Irs Taxes

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

Statute Of Limitations For New Jersey Tax Audits Paladini Law